utah county sales tax calculator

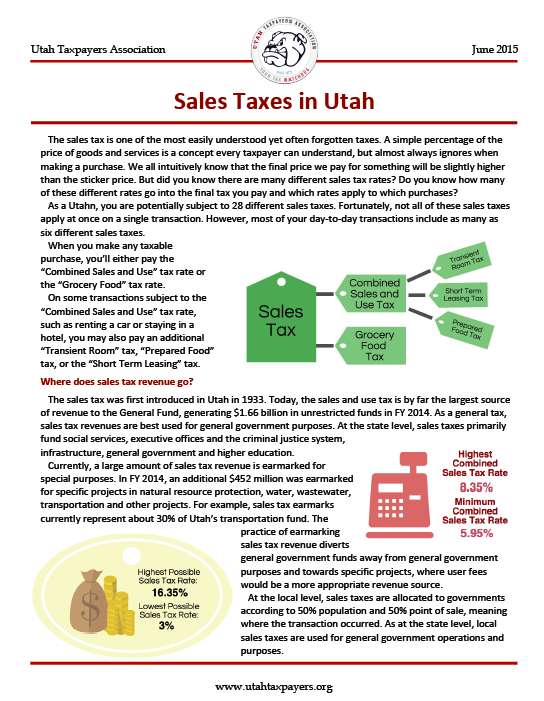

Utah County in Utah has a tax rate of 675 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling 08. Search by District.

Utah Sales Tax Guide And Calculator 2022 Taxjar

In Salt Lake County for example the combined sales tax rate as of January 1 2022 is 725.

. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor. So whilst the Sales Tax Rate in. Sales Tax Rate s c l sr.

Census Bureau American Community Survey 2006. Average Sales Tax With Local. The December 2020 total local sales tax rate was also 7150.

91 rows This page lists the various sales use tax rates effective throughout Utah. L Local Sales Tax Rate. 2022 Utah Sales Tax By County.

Sr Special Sales Tax Rate. Find your Utah combined state and local tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax. Utah has a 485 sales tax and Utah County collects an additional 08. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code.

The minimum combined 2022 sales tax rate for Utah County Utah is. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and. You can find more tax rates and.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. What is the sales tax rate in Utah County. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Counties and cities can charge an additional local sales tax of up to 24 for a maximum. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. The current total local sales tax rate in Utah County UT is 7150. 2022 2021 2020 2019.

Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code. Start filing your tax return now. Utah has recent rate.

Utah sales tax rates vary depending on which. This is the total of state and county sales tax rates. Tax rates tend to be slightly higher in urban areas.

S Utah State Sales Tax Rate 595 c County Sales Tax Rate. With local taxes the total sales tax rate is between 6100 and 9050. To find out the amount of all taxes and fees for your.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Please use the options below to search for your tax rates by district or year. The Utah state sales tax.

Click any locality for a full breakdown of. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Sales Tax On Grocery Items Taxjar

Sales Taxes In The United States Wikiwand

State And Local Sales Taxes In 2012 Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

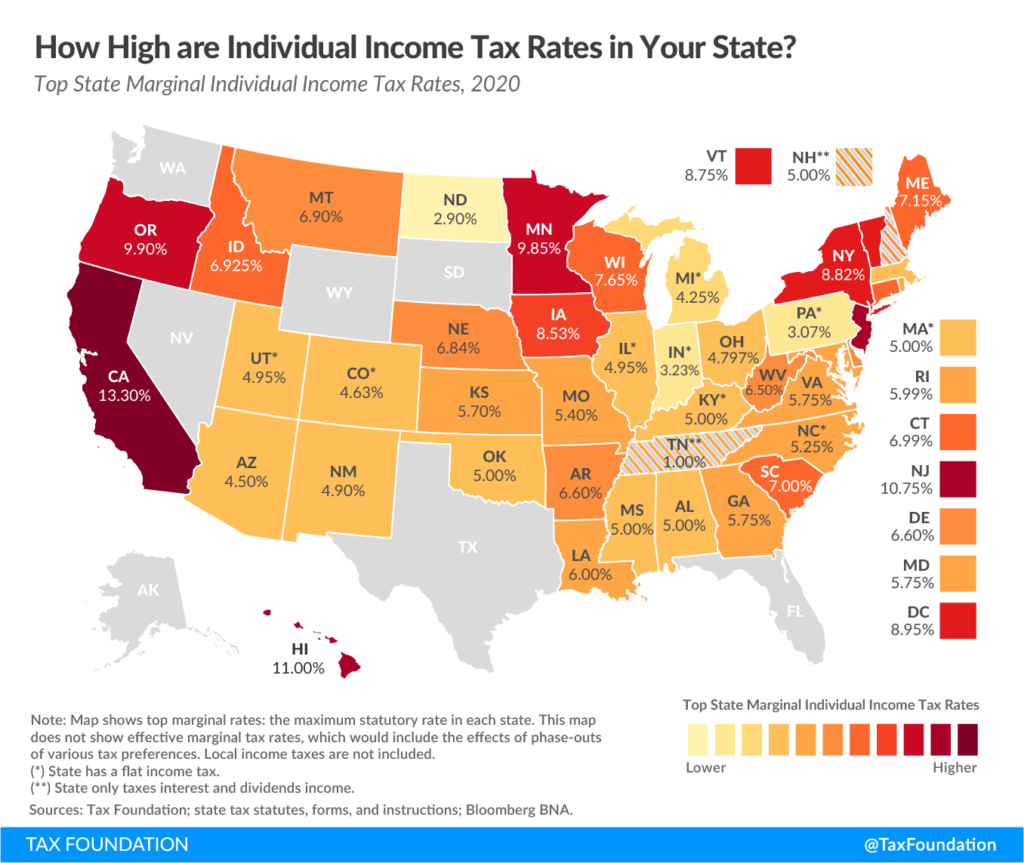

Cannon S Canon Individual Income Tax Rates Across The Nation Utah Needs To Be More Competitive Utah Taxpayers

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Utah Sales Tax Small Business Guide Truic

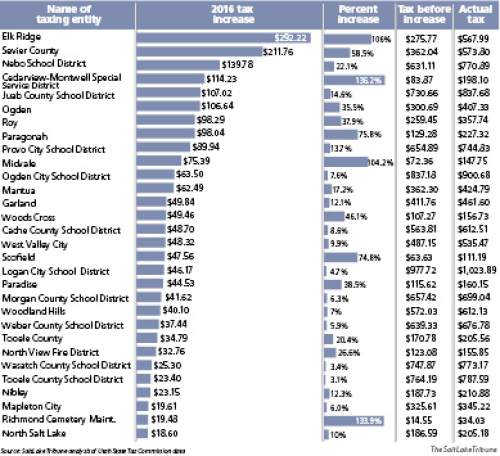

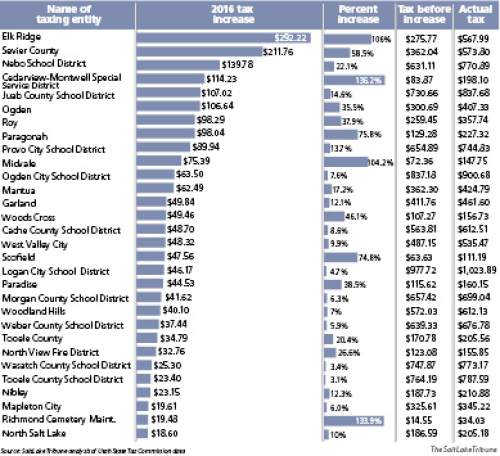

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Sales Tax Cut On Food Seen As Long Shot In Utah Legislature Cache Valley Daily

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation